3Q/23 Earnings Roll Toward First YOY Quarterly Growth Since 3Q/22

by Sequoia Financial Group

by Sequoia Financial Group

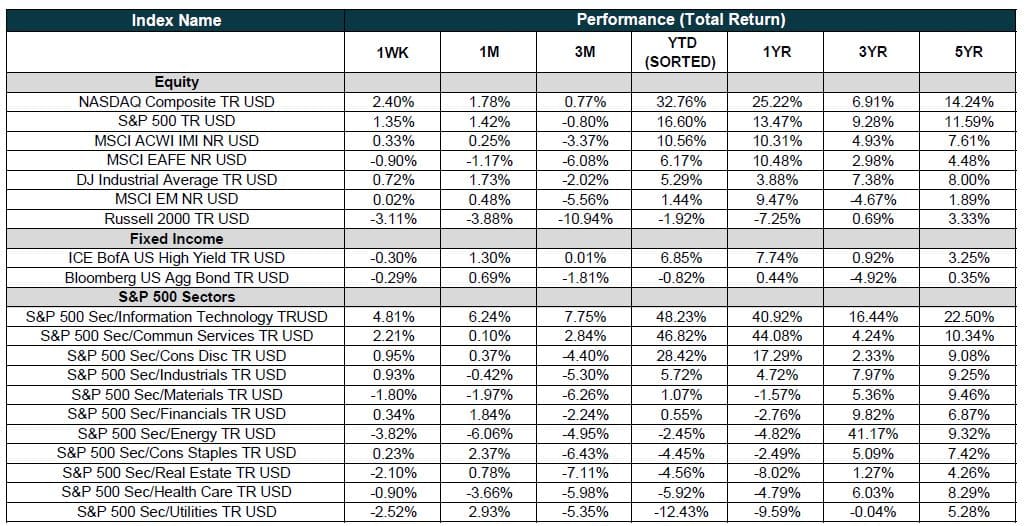

Stocks surged on Friday, recovering the ground lost in the previous session, as US Treasury yields stabilized. The Dow Jones Industrial Average advanced 1.16%. The S&P 500 climbed 1.58%, while NASDAQ Composite added 2.06%.

All 11 sectors of the S&P 500 were positive on Friday, but tech outperformed, rising 2.6%. Microsoft leaped to all-time highs during the session and ended the day up 2.5%. Apple, Meta, Tesla, and Netflix jumped more than 2% each, while Alphabet gained 1.8%1.

Friday’s rally was enough to lift the three major averages for a second consecutive week of gains. The S&P 500 advanced 1.35%, while the Dow added about 0.72%. The NASDAQ was the outperformer, rising 2.40%2.

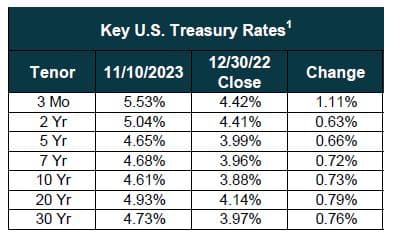

In the fixed income markets, the Bloomberg US Aggregate Bond Index declined 0.29% on the week. The benchmark 10-year Treasury yield ended the week relatively unchanged at 4.61%. This was a marked reversal from Thursday’s action in which the 10-year rate jumped more than 10bps. The spike in yields followed a dismal Treasury bond auction and comments from Federal Reserve Chairman Jerome Powell that suggested more intervention might be needed to quell inflation.

The past two months have seen substantial turmoil in U.S. bond markets, specifically the 10-year Treasury yield. After crossing 5% just a few weeks ago, 10’s rallied down to 4.5% following a weak payroll report, and then sold off on Thursday to close at 4.63%, following a weak 30-year auction and the hack of Chinese bank ICBC.

Strategas analysts believe the drivers of upside pressure on interest rates remain in place, including the U.S. debt, actions by the Bank of Japan, declining Federal Reserve and commercial bank support, sticky inflation, and Treasury richness to global investors. While Treasuries have rallied down off their cycle-high yields, Strategas believes upside pressure on rates will persist until a recession clearly materializes3.

In economic news, consumer sentiment slipped for the fourth straight month in November as inflation expectations rose, according to the latest University of Michigan survey. The headline sentiment index showed a reading of 60.4, down 5.3% from 63.8 in October and below the Dow Jones estimate of 63.7. The Current Conditions Index fell 6.9% from a month ago. Inflation expectations continued to climb: the one-year outlook rose to 4.4%, the highest since April, while the five-year expectation climbed to 3.2%, tied for the highest since June 20084.

As the end of 3Q/23 corporate earnings season draws near, with 92% of S&P 500 companies having reported, the blended (year-over-year) earnings growth rate for the S&P 500 is 4.1%. If 4.1% is the actual growth rate for the quarter, it will mark the first quarter of year-over-year earnings growth reported by the Index since Q3/22. From a valuation perspective, the forward 12-month P/E ratio for the S&P 500 is 18x – below the five-year average of 18.7x but above the 10-year average of 17.5x5.

Sources:

The views expressed represent the opinion of Sequoia Financial Group. The views are subject to change and are not intended as a forecast or guarantee of future results. This material is for informational purposes only. It does not constitute investment advice and is not intended as an endorsement of any specific investment. Stated information is derived from proprietary and nonproprietary sources that have not been independently verified for accuracy or completeness. While Sequoia believes the information to be accurate and reliable, we do not claim or have responsibility for its completeness, accuracy, or reliability. Statements of future expectations, estimates, projections, and other forward-looking statements are based on available information and Sequoia’s view as of the time of these statements. Accordingly, such statements are inherently speculative as they are based on assumptions that may involve known and unknown risks and uncertainties. Actual results, performance or events may differ materially from those expressed or implied in such statements. Investing in equity securities involves risks, including the potential loss of principal. While equities may offer the potential for greater long-term growth than most debt securities, they generally have higher volatility. Past performance is not an indication of future results. Investment advisory services offered through Sequoia Financial Advisors, LLC, an SEC Registered Investment Advisor. Registration as an investment advisor does not imply a certain level of skill or training.

Strong Earnings and Inflation-friendly Data Boost Markets