Markets Surge Despite Wary Fed

by Sequoia Financial Group

by Sequoia Financial Group

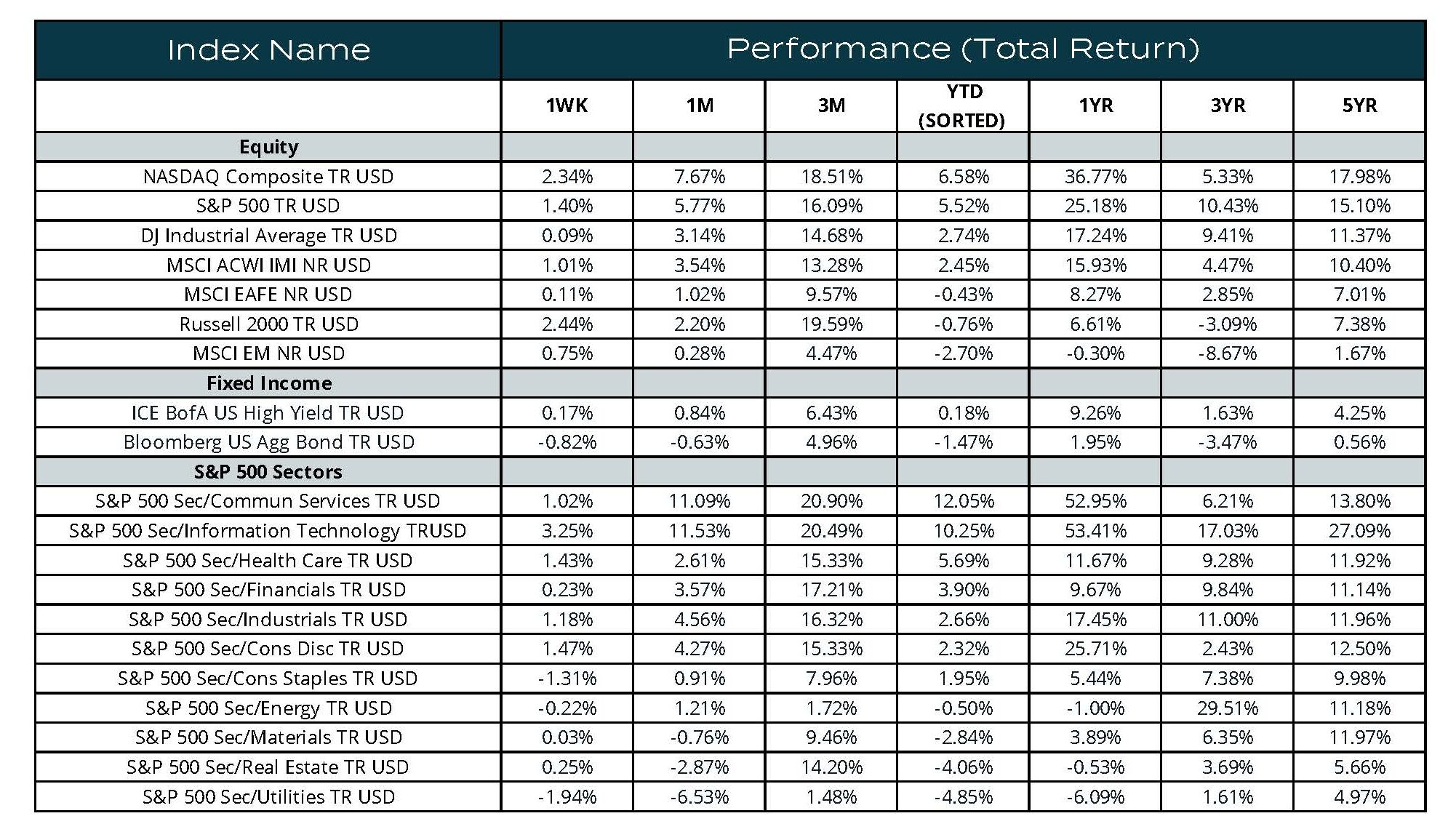

Stocks rose on Friday after December’s revised inflation reading came in lower than first reported, and the S&P 500 closed above the key 5,000 level as investors embraced strong earnings and economic news. For the week, the S&P added 1.40%, while the NASDAQ gained 2.34%. The Dow finished flat at 0.09%1. All three major averages notched their fifth straight winning week and 14th positive week in 15.

Last week was dominated by a series of presentations by Federal Reserve members, with all of them toeing a line consistent with Chairman Powell’s earlier cautionary comments that it would be premature to lower interest rates at this stage. Cleveland Fed President Loretta Mester said a strong economy is enabling policymakers to patiently decide when and how aggressively to cut rates, while Minneapolis Fed President Neel Kashkari said on Wednesday that he anticipates only two to three rate cuts this year. Similar sentiments were echoed by Fed Governor Kugler and Fed Presidents Collins and Barkin2.

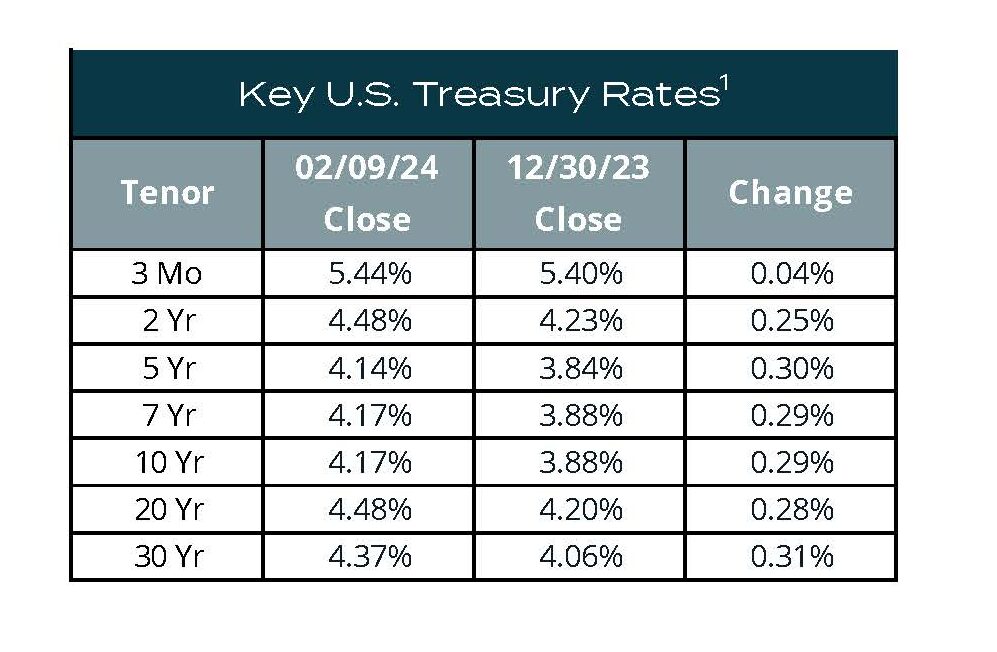

Earlier in the week, the bond market reacted negatively to Powell’s comments as investors weighed the path ahead for interest rates and the notion that cuts may come later than expected, resulting in the 10-year and 30-year US Treasury bonds rising to 4.17% and 4.35%3, respectively. For the week, the Bloomberg US Agg Bond Index declined -0.82%4.

Economic data released on Monday by the Institute for Supply Management (ISM) showed that its non-manufacturing PMI increased to 53.4 last month from 50.5 in December5. A reading above 50 indicates growth in the services industry, which accounts for more than two-thirds of the US economy. Economists polled by Reuters had forecast the Index rising to 52. Meanwhile, the prices consumers pay in the marketplace rose at an even slower pace than originally reported, according to closely watched revisions released on Friday by the Bureau of Labor Statistics. Revised Consumer Price Index (CPI) data showed that the broad basket of goods and services it measures increased 0.2% month on month in December, less than the originally reported 0.3%. While the change is only modest, it helped confirm that inflation was moderating as 2023 ended, giving more leeway to the Federal Reserve to start cutting interest rates later this year6.

Corporate earnings released throughout the week showed weakness in global consumer stocks. Dow component McDonald’s reported a mixed quarter: the fast-food titan beat earnings estimates but missed on revenue as international markets lagged7. Yum Brands reported quarterly earnings and revenue that missed analysts’ expectations as KFC, Taco Bell and Pizza Hut all posted weaker-than-expected sales8. Similarly, Starbucks also missed Wall Street’s expectations when it reported the week before last. PepsiCo earnings topped Wall Street’s expectations, but it missed on revenues. The company’s net sales fell 0.5% in the fourth quarter with executives citing higher borrowing costs and lower personal savings squeezing consumers’ budgets, especially in North America9.

Meanwhile, in other industries, automaker Ford surprised the street, gaining nearly 6% after beating Wall Street’s fourth-quarter estimates, issuing higher-than-expected full-year guidance and announcing plans to issue a special dividend10. Another Dow component, The Walt Disney Company, surged 13% after surpassing quarterly earnings estimates and raising its guidance. Technology-focused chipmaker and designer Arm Holdings jumped 59% after reporting stronger-than-expected earnings and providing an upbeat profit forecast.

Despite strong earnings and a more favorable inflation outlook, an interest rate cut by the Federal Reserve in March is unlikely, especially after the comments of Chairman Powell and his Fed colleagues. Expectations for cuts have eased since the remarks, with the probability of a cut next month last at 16%, according to CME Group’s FedWatch Tool11.

Sources:

- Morningstar Direct

- https://www.cnbc.com/2024/02/07/feds-neel-kashkari-expects-only-two-or-three-interest-rate-cuts-this-year.html

- https://home.treasury.gov/resource-center/data-chart-center/interest-rates/TextView?type=daily_treasury_yield_curve&field_tdr_date_value_month=202402

- Morningstar Direct

- https://www.ismworld.org/supply-management-news-and-reports/reports/ism-report-on-business/services/january/

- https://www.cnbc.com/2024/02/09/-inflation-in-december-was-even-lower-than-first-reported-the-government-says.html

- https://www.cnbc.com/2024/02/05/mcdonalds-mcd-q4-2023-earnings.html

- https://www.cnbc.com/2024/02/07/yum-brands-yum-q4-2023-earnings.html

- https://www.cnbc.com/2024/02/09/pepsico-pep-q4-2023-earnings.html

- https://www.cnbc.com/2024/02/06/ford-f-q4-2023-earnings.html?&qsearchterm=ford%20earnings

- https://www.cmegroup.com/markets/interest-rates/cme-fedwatch-tool.html

The views expressed represent the opinion of Sequoia Financial Group. The views are subject to change and are not intended as a forecast or guarantee of future results. This material is for informational purposes only. It does not constitute investment advice and is not intended as an endorsement of any specific investment. Stated information is derived from proprietary and nonproprietary sources that have not been independently verified for accuracy or completeness. While Sequoia believes the information to be accurate and reliable, we do not claim or have responsibility for its completeness, accuracy, or reliability. Statements of future expectations, estimates, projections, and other forward-looking statements are based on available information and Sequoia’s view as of the time of these statements. Accordingly, such statements are inherently speculative as they are based on assumptions that may involve known and unknown risks and uncertainties. Actual results, performance or events may differ materially from those expressed or implied in such statements. Investing in equity securities involves risks, including the potential loss of principal. While equities may offer the potential for greater long-term growth than most debt securities, they generally have higher volatility. Past performance is not an indication of future results. Investment advisory services offered through Sequoia Financial Advisors, LLC, an SEC Registered Investment Advisor. Registration as an investment advisor does not imply a certain level of skill or training.

President Trump Signs the ‘One Big Beautiful Bill’ into Law