Equity Markets Struggling to Maintain Their Footing

by Sequoia Financial Group

by Sequoia Financial Group

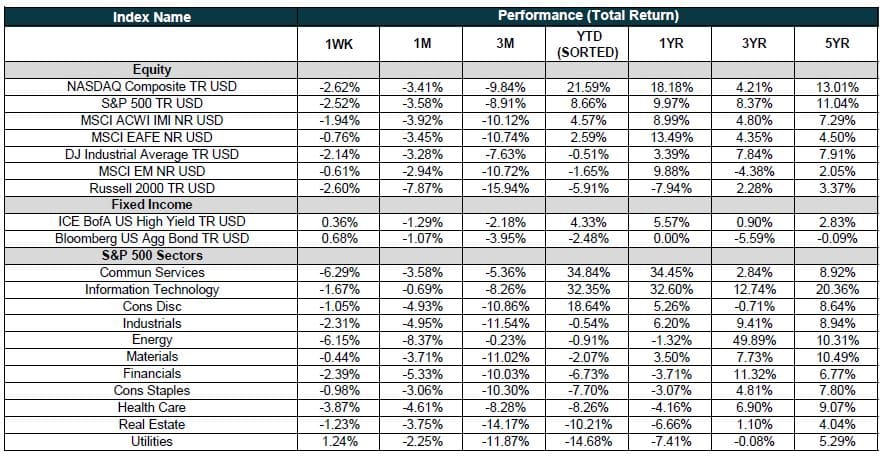

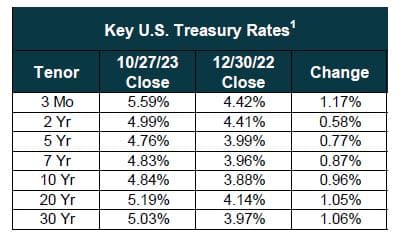

Last week was a rough one for equity markets, which fell sharply to their lowest levels since April. Fear of higher interest rates, mixed-to-poor earnings results and reactions, and escalating geopolitical tensions posed too much uncertainty for investors. The selling was broad and the NASDAQ, S&P 500, and Russell 2000 were lower by 2.62%, 2.52%, and 2.60%, respectively. Treasury yields stabilized slightly this week but bond volatility remains elevated.

The week began with continued selling pressure as markets struggled to find a direction. Investors were hesitant as they braced for a week full of corporate earnings, macroeconomic updates, and a crisis in the Middle East. Treasury yields retreated on Monday after Bill Ackman stated he had covered his short bet on US Treasuries because he believes the economy is slowing faster than data suggests.1 Markets bounced back on Tuesday and broke a streak of five straight days of declines, the longest so far this year. Interest rates continued to stabilize following Monday’s reversal, which helped improve risk sentiment. However geopolitical tensions remain elevated.

Equity markets fell sharply on Wednesday following GOOG’s earnings report that showed weaker-than-expected Cloud revenues.2 Big tech led the declines but the sell-off was broad. In sharp contrast, MSFT traded higher after reporting margin expansion and Azure growth reaccelerating helped by investments in AI.3 Markets continued their declines on Thursday as investors digested META’s earnings report. META beat estimates as the company continues to gain operational efficiencies but the Q4 outlook was disappointing.4 While earnings results have generally been in line with expectations, guidance has remained underwhelming, and misses have been punished heavily.

Macroeconomic data continues to surprise on the upside, showing US economic strength. The Q3 GDP estimate came in at 4.9%, beating consensus and demonstrating the fastest growth in nearly two years.5 The increase was primarily driven by a 4% rise in personal consumption led by both goods and services. 5 Personal consumption is also nearly the highest in two years. Durable goods orders came in ahead of consensus at 4.7%, led by transportation equipment.6 The US labor market remains strong with initial claims still low at 210K.7

Markets tried to bounce on Friday after a strong earnings report from AMZN, which delivered better-than-expected operating margins and stabilization in its AWS growth rate.8 Core PCE came in slightly above consensus at 0.4%, primarily driven by energy prices.9 Personal consumption surprised on the upside at 0.7%, led by international travel, housing, and healthcare.9 While economic data continues to support a resilient US economy and a disinflationary trend, recent corporate commentary implies a weaker macro environment than current data suggests.

Sources

- https://www.cnbc.com/2023/10/23/bill-ackman-covers-bet-against-treasurys-says-too-much-risk-in-the-world-to-bet-against-bonds.html

- https://abc.xyz/assets/4a/3e/3e08902c4a45b5cf530e267cf818/2023q3-alphabet-earnings-release.pdf

- https://view.officeapps.live.com/op/view.aspx?src=https://c.s-microsoft.com/en-us/CMSFiles/PressReleaseFY24Q1.docx?version=23ad8ec7-1358-cdf2-6a2f-b65c3322d901

- https://investor.fb.com/investor-news/press-release-details/2023/Meta-Reports-Third-Quarter-2023-Results/default.aspx

- https://www.bea.gov/news/2023/gross-domestic-product-third-quarter-2023-advance-estimate

- https://www.census.gov/manufacturing/m3/adv/current/index.html

- https://www.dol.gov/ui/data.pdf

- https://ir.aboutamazon.com/news-release/news-release-details/2023/Amazon.com-Announces-Third-Quarter-Results/default.aspx

- https://www.bea.gov/news/2023/personal-income-and-outlays-september-2023

The views expressed represent the opinion of Sequoia Financial Group. The views are subject to change and are not intended as a forecast or guarantee of future results. This material is for informational purposes only. It does not constitute investment advice and is not intended as an endorsement of any specific investment. Stated information is derived from proprietary and nonproprietary sources that have not been independently verified for accuracy or completeness. While Sequoia believes the information to be accurate and reliable, we do not claim or have responsibility for its completeness, accuracy, or reliability. Statements of future expectations, estimates, projections, and other forward-looking statements are based on available information and Sequoia’s view as of the time of these statements. Accordingly, such statements are inherently speculative as they are based on assumptions that may involve known and unknown risks and uncertainties. Actual results, performance or events may differ materially from those expressed or implied in such statements. Investing in equity securities involves risks, including the potential loss of principal. While equities may offer the potential for greater long-term growth than most debt securities, they generally have higher volatility. Past performance is not an indication of future results. Investment advisory services offered through Sequoia Financial Advisors, LLC, an SEC Registered Investment Advisor. Registration as an investment advisor does not imply a certain level of skill or training.

Q2 Market Review – Stocks Climb the Wall of Worry – Again