Employment Data Saves Markets After Tense Week

by Sequoia Financial Group

by Sequoia Financial Group

Following a period of record highs, equity markets took a breather this week, eking out minimal gains as geopolitical tensions, mixed economic data and a short-lived industrial dispute dictated trading activity.

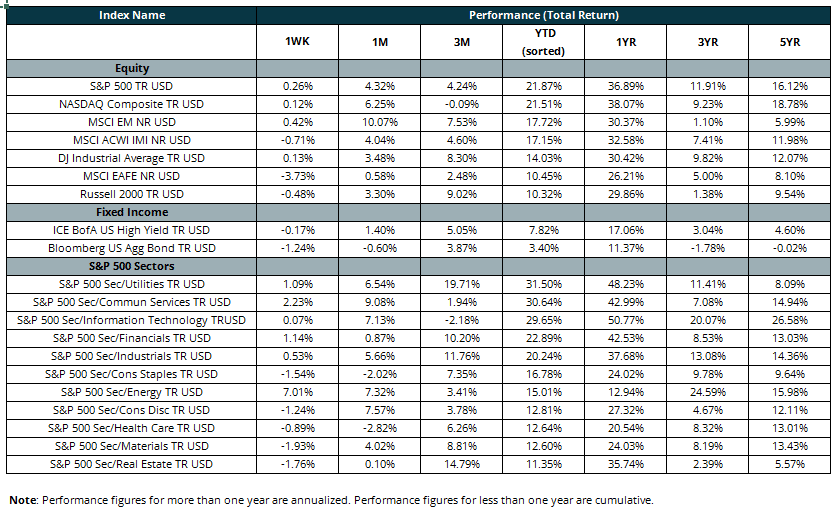

Monday saw the close of the third quarter. While September is typically the worst month of the year for stocks1, this year it broke with past trends2. All three major averages posted monthly gains, and it was the first positive September for the S&P 500 since 2019. All three major indices also ended the third quarter in positive territory with the S&P 500 up 5.89%, the Dow higher by 8.72% and the NASDAQ Composite advancing 2.76%.3

October started with confirmation from the Institute of Supply Management that the manufacturing sector continued to struggle. The sector, which accounts for 14% of US GDP, saw activity contract in September for the sixth consecutive month and for the 22nd time in the last 23 months. The Manufacturing PMI of 47.2 percent in September matched the figure recorded in August. The outlook also remains challenged, with the New Orders Index remaining in contraction territory, registering 46.1 percent.4

Stocks retreated on Tuesday following escalating geopolitical tensions in the Middle East as Iran launched a missile attack on Israel.5 Investors are preparing for some uncertainty as Israel starts a ground operation into Lebanon and considers direct retaliatory action against Iran.6 The growing fears have also driven oil prices higher. US crude futures rose more than 1.5%, bringing its week-to-date advance to 4.6%.

Investors faced further uncertainty last week as the Members of the International Longshoremen’s Association, the union representing 50,000 members covered under the contract with the United States Maritime Alliance, planned a work stoppage over a pay dispute. The stoppage had threatened to disrupt supply chains, causing shortages of some consumer goods and supplies needed to keep US factories running. It also temporarily cut off the flow of many American exports, putting overseas sales at risk for some US businesses. However, the two sides reached an agreement on the key dispute on Friday, resulting in only limited damage to America’s economy.7

By Friday, markets were on track for a losing week. However, stocks rallied after data showed nonfarm payrolls grew by 254,000 jobs in September, far outpacing the gain of 150,000 expected by economists polled by Dow Jones. The unemployment rate ticked down to 4.1% despite expectations for it to hold steady at 4.2%.8

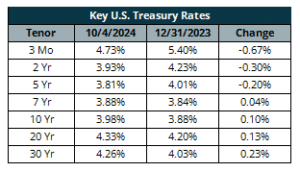

The strength of the jobs report is likely to provide the Federal Reserve some relief as it contemplates further reductions in the federal funds rate. Fed Chair Powell said earlier in the week that the central bank is “not on any preset course” when it comes to the next steps for rate policy. He said to expect two more cuts this year – that is, a quarter percentage point each – if the economy performs as anticipated.9 According to the CME FedWatch, markets are currently ascribing a 95% chance of a 25bps cut in the fed funds rate the Fed’s November meeting.

Sources:

- https://www.cnbc.com/2024/09/03/septembers-poor-history-is-hard-to-ignore-but-market-has-many-things-on-its-side-including-the-fed.html

- https://www.cnbc.com/2024/09/24/market-headed-for-first-winning-september-in-5-years.html

- Morningstar Direct

- https://www.ismworld.org/supply-management-news-and-reports/reports/ism-report-on-business/pmi/september

- https://www.cnbc.com/2024/10/01/iran-readying-imminent-ballistic-missile-attack-against-israel-us-official-tells-nbc-news.html

- https://www.cnbc.com/2024/10/01/israeli-forces-launch-ground-offensive-in-lebanon-as-markets-eye-escalation-.html

- https://edition.cnn.com/2024/10/04/business/port-strike-ends-whats-next/index.html

- https://www.cnbc.com/2024/10/03/stock-market-today-live-updates.html

- https://www.cnbc.com/2024/09/30/powell-indicates-further-rate-cuts-but-insists-the-fed-is-not-on-any-preset-course.html

The views expressed represent the opinion of Sequoia Financial Group. The views are subject to change and are not intended as a forecast or guarantee of future results. This material is for informational purposes only. It does not constitute investment advice and is not intended as an endorsement of any specific investment. Stated information is derived from proprietary and nonproprietary sources that have not been independently verified for accuracy or completeness. While Sequoia believes the information to be accurate and reliable, we do not claim or have responsibility for its completeness, accuracy, or reliability. Statements of future expectations, estimates, projections, and other forward-looking statements are based on available information and Sequoia’s view as of the time of these statements. Accordingly, such statements are inherently speculative as they are based on assumptions that may involve known and unknown risks and uncertainties. Actual results, performance or events may differ materially from those expressed or implied in such statements. Investing in equity securities involves risks, including the potential loss of principal. While equities may offer the potential for greater long-term growth than most debt securities, they generally have higher volatility. Past performance is not an indication of future results. Investment advisory services offered through Sequoia Financial Advisors, LLC, an SEC Registered Investment Advisor. Registration as an investment advisor does not imply a certain level of skill or training.

Equity Markets Reach Records After Mid-East Tensions Ease