Bonds Stuck in Neutral Despite Rate Cut

by Sequoia Financial Group

by Sequoia Financial Group

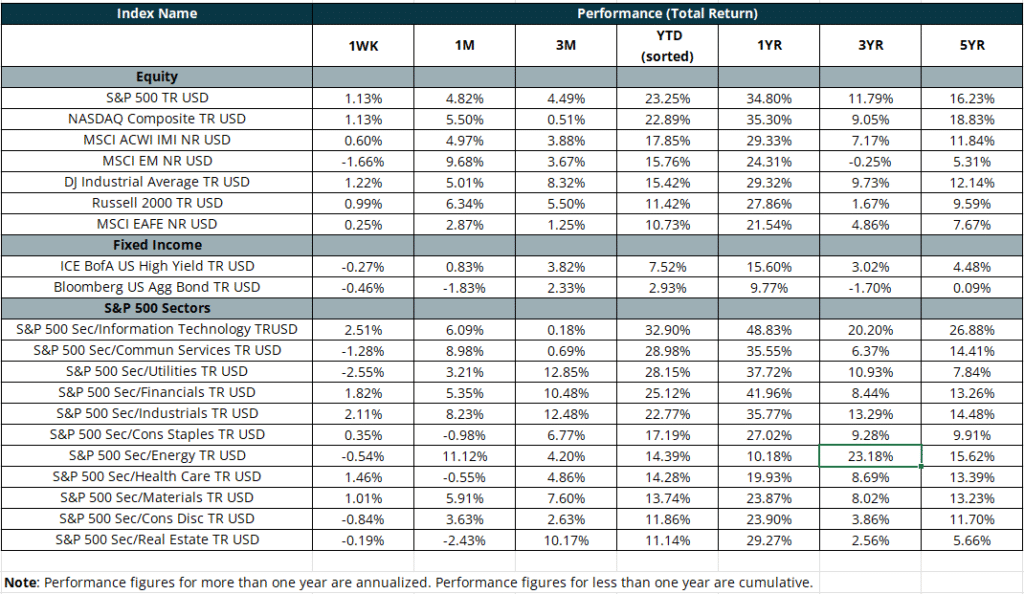

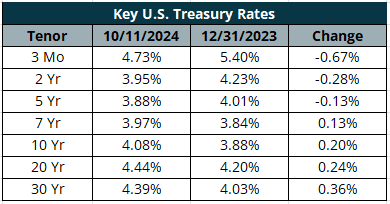

Lower interest rates typically translate to lower bond yields and higher bond prices. However, we’ve seen just the opposite since the Fed cut its benchmark interest rate by half a percentage point on September 18. In fact, the yield on the 10-year Treasury bond has since jumped to 4.07% from 3.73%.[1] And bond prices have done the opposite, as the benchmark Bloomberg Aggregate Bond Index has dropped roughly 1.8% over the last month.

The Fed’s move affected short-term bond yields, as evidenced by money market yields dropping below 5%.[2] But long-term bond yields continue to be driven by market forces outside of the Fed’s direct control, and more specifically by inflation expectations, economic growth, and monetary policy. And inflation concerns have recently resurfaced. The Consumer Price Index, released on Thursday, was expected to climb just 2.2% for the trailing 12 months, but came in a bit hotter at 2.4%. Producer prices, released Friday, were forecast to rise 1.9%, but increased just 1.8%. However, consumers’ 12-month inflation expectations jumped to 2.9% from 2.7%.[3] Overall, the inflation reports provided little relief for frustrated bond investors.

Stocks, on the other hand, continued to rally, posting gains for the fifth week in a row. The week started slow but was backloaded with events: inflation data was reported on Thursday and Friday, and bank earnings were also released on Friday. And the banks delivered. Analysts had dialed back their expectations, thinking banks would get squeezed by clients shifting assets into higher-yielding assets from low-yielding checking and savings accounts.[4] But the squeeze was smaller than expected. In fact, net interest income for both JP Morgan and Bank of New York Mellon increased quarter over quarter, and the two banks beat analyst expectations for both income and revenue. BlackRock and Wells Fargo also topped analyst estimates, helping the S&P 500 reach yet another record high.[5]

Earnings season kicks into higher gear this week. Goldman Sachs, Bank of America, and Citigroup will look to keep the financial sector rolling. We’ll also get reports from Johnson & Johnson, Netflix, United Airlines, and many more. On the economic front, we’ll get a look at retail sales and jobless claims. But earnings will likely be the main driver of the financial markets for the next few weeks, until the fast-approaching election on November 5, and the next Fed meeting on November 6-7.

Sources:

- https://finance.yahoo.com/quote/%5ETNX/

- https://www.msn.com/en-us/money/savingandinvesting/5-money-market-rates-are-done-where-to-put-cash-now/ar-AA1s8ftr

- https://www.reuters.com/markets/us/us-producer-prices-unchanged-september-2024-10-11/

- https://finance.yahoo.com/news/biggest-us-banks-face-revenue-110000083.html

- https://www.cnbc.com/2024/10/10/stock-market-today-live-updates.html

The views expressed represent the opinion of Sequoia Financial Group. The views are subject to change and are not intended as a forecast or guarantee of future results. This material is for informational purposes only. It does not constitute investment advice and is not intended as an endorsement of any specific investment. Stated information is derived from proprietary and nonproprietary sources that have not been independently verified for accuracy or completeness. While Sequoia believes the information to be accurate and reliable, we do not claim or have responsibility for its completeness, accuracy, or reliability. Statements of future expectations, estimates, projections, and other forward-looking statements are based on available information and Sequoia’s view as of the time of these statements. Accordingly, such statements are inherently speculative as they are based on assumptions that may involve known and unknown risks and uncertainties. Actual results, performance or events may differ materially from those expressed or implied in such statements. Investing in equity securities involves risks, including the potential loss of principal. While equities may offer the potential for greater long-term growth than most debt securities, they generally have higher volatility. Past performance is not an indication of future results. Investment advisory services offered through Sequoia Financial Advisors, LLC, an SEC Registered Investment Advisor. Registration as an investment advisor does not imply a certain level of skill or training.

Equity Markets Reach Records After Mid-East Tensions Ease